Home Assignment

Long run growth of a chosen country

Empirical analysis of long run growth requires GDP estimates of historical ages. This work has been initiated by Angus Maddison. He dedicated his life to estimate GDP of different countries in the world long back to the medival ages. His life has been summarized in an Economist article that shows clearly the importance of his work.1 After his death, a group of colleagues of him continued his work at the Groningen University. Today, the so-called Maddison database is widely considered as „the international database” of historical GDP data. You can find detailed information about the project on its website2 and you can download the most recent version of the database in an excel file.3

Your task in this home assignment is to choose a country, for which there are long term GDP data in this database and analyse it using the Solow model. Please follow the steps below:

Steps

- Download the Maddison database and choose a country for your analysis. Choosing a country with having data in the 19th century will result a data series at least a century long. Countries with shorter data series will not beaccepted!

- Calculate the natural logarithm of the GDP per capita and plot the data series in a graph. This graph should be copied to the

- Computethe average growth rate of GDP per capita for the whole In doing so follow the instructions below (see section called „Growth rates arithmetics”).

- The graph helps you to identify subperiods with seemingly different growth rates. Explanation: in your graph the slope of the data series is approximately the average growth rate. Find these subperiods (like 3-5 subperiods, not more) and calculate the average growth rates for these subperiods

- Check the history of the country. Find explanation for the

- Finally, summarize your work in a word document 1-2 pages long. In this document show the graph, show the calculated average growth rates and analyse the long run growth of the chosen country.

- When you are ready, upload your work to moodle, both the word document and the excel file with your calulcations in it must be submitted before thedeadline!

Growth rates arithmetics

To calulcate average growth rates we usually start with the following formula. If a country’s real gdp

(x) average growth rate is g in a period between t1 and t0 then its value can be written as follows:

By taking logarithm of the equation you get:

1 https://www.economist.com/node/16004937?story_id=16004937

2 https://www.rug.nl/ggdc/historicaldevelopment/maddison/

3The database is available here: https://www.rug.nl/ggdc/historicaldevelopment/maddison/data/mpd2018.xlsx .

Rearranging this equation you get:

When g is small enough, close to 0 (which actually the case if g is a growth rate) then ln(1 + g) ≈ g, so therefore using the previous formula you have the most simple expression for the average growth rate between t0 and t1 :

思路:

这是一个代写Excel的经济GDP趋势案例分析,数据来源于”Maddison database”,选择一个国家,这个数据库中有长期GDP数据,并使用索洛模型(Solow model) 进行分析。

根据作业要求,选取了美国1800-2016期间共217年的人均GGP数据

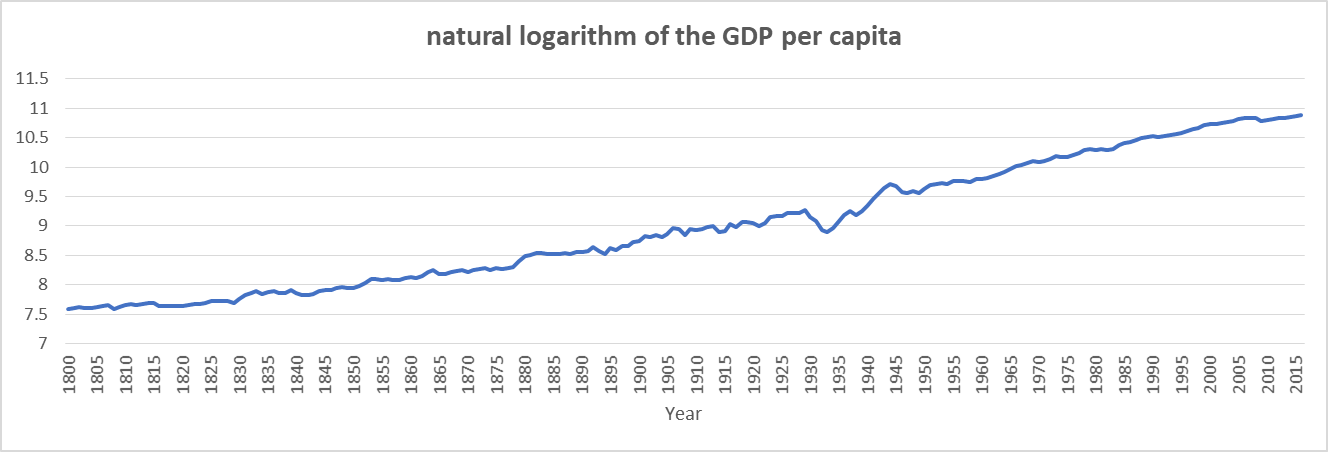

对人均GDP进行了取自然对数的操作,并利用折线图展示,图表如下

根据人均GDP平均增长率的计算公式

对整个挑选1800-2016年间的数据进行计算, 人均GDP平均增长率为1.52%

美国从1800-2016年间,除了经济危机、经济衰退期间短时间内出现了下跌的迹象,人均GDP平均增长率总体上一直处于增长的趋势,其中二战期间增速较为明显,但是近年来受次贷危机的持续影响增速有所缓减。

根据人均GDP自然对数的趋势分布,选取的4个阶段进行分析,分别为:

- 1929-1933:人均GDP平均增长率为29%

1929年至1933年,美国爆发大规模经济危机。当时”市场不干预主义”占垄断地位,美联储面对股灾袖手旁观,造成了股市崩溃和大萧条。

- 1939-1945:人均GDP平均增长率为08%

在二战期间美国的外乡没有堕入烽火当中,这就包管了美国产业平安的临盆情况,而且美国向参战国大批贩卖兵器、战略物资,这让美国经济在二战中飞速发展,美国的工业产能也达到了巅峰

- 1948-1949 :人均GDP平均增长率为-3.12%

1948年8月至1949年10月,美国发生了战后第一次经济危机。这次危机是美国经过了战后短暂繁荣后的突然爆发。形成危机的根本原因,是第二次世界大战时期美国形成的高速生产惯性,和战后重建时国际国内市场需求暂时萎缩,两者形成了尖锐的矛盾。美国经济进入衰退。

- 2007-2010:人均GDP平均增长率为-1.09%

2007年3月爆发的次贷危机,一直呈现蔓延并深化的趋势。楼市暴跌沉重打击了美国和全球的金融市场。在愈演愈烈的次贷风波中,众多对冲基金沦陷,许多欧美知名大投行相继中箭落马,金融机构股票狂跌,资金链濒于断裂,资本泡沫随之席卷而来,逐渐发展为一场系统性金融危机风暴,也是美国金融市场20年来最严重的一场危机,其规模之大、影响之远仅次于30年代大萧条。