ACFI 342

MAY EXAMINATIONS 2022

Financial Risk Management

代考财务风险管理 Compute the expected loss or gain if the £ exchange rate appreciates by 1 percent. State your answer in £s and $s

INSTRUCTIONS TO CANDIDATES 代考财务风险管理

Student declaration:

I confirm that I have read and understood the University’s Academic Integrity policy. I confirm that I have acted honestly, ethically and professionally in conduct leading to assessment for the programme of study. I confirm that I have not copied material from another source nor committed plagiarism nor fabricated data when completing the attached piece of work. 代考财务风险管理

I confirm that I have not previously presented the work or part thereof for assessment for another University of Liverpool module. I confirm that I have not colluded with any other student in the preparation and production of this work. I confirm that I have not incorporated into this assignment material that has been submitted by me or any other person in support of a successful application for a degree of this or any other University or degree awarding body. Students who require sympathetic marking should ensure that they attach the Sympathetic Marking Indicator to the first page of the document prior to submission

PLEASE ANSWER ALL QUESTIONS

QUESTIONS 代考财务风险管理

1) Discuss optimal hedging strategies for an AAA-rated firm and a BBB-rated firm [12 marks]

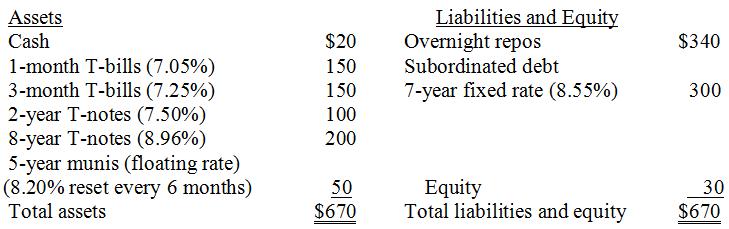

2) ABC Bank has the following balance sheet:

Required

(i)Assuming a 2-year planning period, calculate the repricing gap and the impact on net interest income if interest rates on rate sensitive assets (RSAs) increase 50 basis points and on rate sensitive liabilities (RSLs) increase 75 basis points

(ii)Comment on the possible effect of a central bank’s policy of setting negative nominal interest rates on the bank balance sheet [14 marks]

3) Consider the following returns for a portfolio of stocks that replicates the S&P 500 index that has a current market value of £250,000:

| Time | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 |

| Return (%) | 0.1% | 0.2% | -0.15% | 0.12% | 0.08% |

Required 代考财务风险管理

(i)Calculate the daily VAR using the historical simulation approach and an 80% confidence interval (Note: do not use the PERCENTILE function in MS Excel)

(ii)Assuming a zero mean return, compute the daily VAR using the RiskMetrics approach and an 80% confidence interval and comment on the difference with the 1-day VAR based on historical simulation [14 marks]

4) Consider a small-sized bank with the following portfolio of loans:

| Debtor | Amount |

| OECD banks (AA rated) | $100 million |

| Private Oil firms (not rated) | $100 million |

| Private car firms (B rated) | $100 million |

| OECD central governments (A rated) | $100 million |

| 1-year loan commitment to OECD bank (A rated) – drawn amount of 40% | $100 million |

Required

(i)Calculate the credit risk capital requirement for the bank under the standardized approach in Basel II

(ii)Determine the minimum amount of core TIER 1 capital required by Basel III rules in normal market conditions [14 marks]

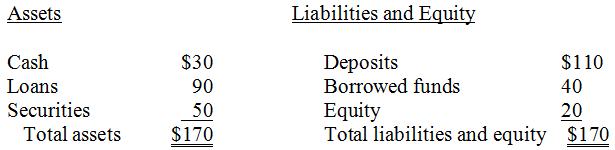

5) ABC Bank has the following balance sheet (in millions):

ABC Bank’s largest customer decides to exercise a $15 million loan commitment.

Required

(i)How will the new balance sheet appear if ABC Bank uses stored liquidity management as its main risk management strategy? Comment on the potential impact of this strategy on the bank’s interest margins

(ii)Discuss the causes of the Northern Rock demise [14 marks]

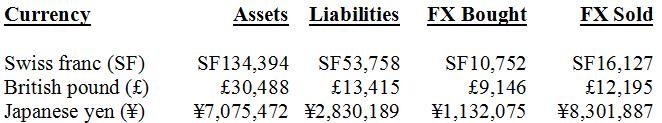

6) The following are the foreign currency positions of an FI, expressed in the foreign currency.

The exchange rate of dollars per SF is 0.9301, of dollars per British pound is 1.6400, and of dollars per yen is 0.010600. 代考财务风险管理

Required

(i)Determine the FI’s net exposure in British pounds stated in £ and in dollars ($)

(ii)Compute the expected loss or gain if the £ exchange rate appreciates by 1 percent. State your answer in £s and $s [12 marks]

7) Consider a no-interest loan with current rating A, maturity of 3 years and amount to be repaid at maturity of $100 million. The recovery rate in case of default is 50% of the repayment value. Assume a default probability of 2.02% and the following yield curve for an A-rated corporate: 代考财务风险管理

| Time to maturity | 1 year | 2 years | 3 years | 4 years | 5 years |

| Spot rate | 2.80% | 3.01% | 3.21% | 3.73% | 3.98% |

Required

(i)Calculate the future expected value and volatility 1 year ahead for this loan

(ii)Assuming that the future returns of the borrower’s assets follow a standard normal distribution, compute the default threshold of the borrower and explain how it can be used to generate future rating scenarios and loan values [20 marks]