AcF 311 Coursework Lent Term 2022

Answer both Part A and Part B

Case study: ADVENT plc

ADVENT plc (ADVENT) is a large, UK-based company which offers adventure travel and related services. ADVENT has a 31 December year-end and prepares its financial statements under UK-adopted IFRS.

So far, it has been operating from its offices in the UK assisting UK customers in planning and organizing adventure trips to destinations all over the world. In the future, it intends to expand its operations internationally, i.e., to set up offices in other countries and to start serving non-UK customers.

On 1 January 2022, to finance this expansion, the CEO of ADVENT succeeded in taking out a loan with a large UK bank, which has a reputation for building and maintaining long-term relationships with its clients. The loan makes up a significant amount of total assets and has a maturity of 15 years.

The terms of the loan are as follows: 会计税法代写

o The loan principal is £25 million.

o Arrangement fees were £250,000.

o Interest is payable at 3% pa of the principal amount of the loan for the first

5 years rising to 5% pa for the remainder of the loan term.

o The interest is payable annually in arrears on 1 January.

o The loan will be repaid in full after 15 years.

In addition, the CEO wants to list ADVENT’s shares on the London Stock Exchange (LSE), in the Standard Segment of the Main Market. The CEO expects the process of listing to be quick and hassle-free but has to obtain approval from ADVENT’s existing shareholders before he can initiate it. If approval is obtained, he wants to initiate the listing in 2023. 会计税法代写

Existing shareholders comprise a group of 30 individuals with relatively low stakes each, as well as a blockholder with a stake of 55% and a seat on the board of directors as a non-executive director (a blockholder is an investor who owns a large stake).

The blockholder invested in ADVENT shortly after the incorporation of the company and pursues long-term interests; he has no intention to sell his stake anytime soon. The group of 30 individuals, on the other hand, invested in ADVENT at various points in time without any long-term interests; they saw in ADVENT a profitable investment opportunity and are ready to sell their shares as soon as their return is sufficiently high.

The CEO does not expect to obtain shareholder approval without difficulties since he needs 75% of the voting rights in support of his proposal.

Yet, he hopes to be able to convince existing shareholders that a listing at the LSE will open up financing sources not just for the first stage of the expansion but also for potential further stages in later years.

The CEO proposal refers to a stock exchange listing via the issuance of new shares through an Initial Public Offering (IPO). Existing as well as future shareholders have one vote per share.

PART A 会计税法代写

REQUIRED:

a)

The above case study hints at several relationships between principal(s) and/or agent(s) in which conflicts of interest can arise. Specify two of these relationships and, for each:

i) identify the parties involved and assign them the role of principal(s) or agent(s);

ii) explain the objectives and incentives each party has and the resulting conflict of interest; and

iii) explain the information asymmetries between the parties involved that usually exist in practice. (900 words max., 20 marks)

b) 会计税法代写

The CEO expects the process of listing ADVENT’s shares at the LSE “to be quick and hassle-free.” Look up the requirements that need to be met in order to list shares and to maintain the listing afterwards for the Standard Segment of the LSE Main Market.

i) Specify and briefly explain the main requirements. Focus on requirements that ADVENT does not meet already because of rules for unlisted companies.

ii) Identify and briefly characterize the enforcement agencies involved.

iii) Select one written rule that is related to your answer in i) and explain how it is implemented and enforced.

iv) Do you agree with the CEO’s expectation? Explain your answer. (630 words max., 14 marks)

c) 会计税法代写

Based on the information in the case study and your answers above, summarise the costs and benefits of the listing at the LSE from the perspective of ADVENT. You should report on at least two broad categories of costs and two broad categories of benefits. (270 words max., 6 marks)

d)

ADVENT’s different stakeholders are likely to have different views on the listing at LSE. Explain how you expect:

i) the blockholder;

ii) the group of 30 individuals who are also invested in ADVENT; and

iii) the bank which provided the loan to view the proposal of the CEO. (450 words max., 10 marks)

Total for PART A: 50 marks

PART B 会计税法代写

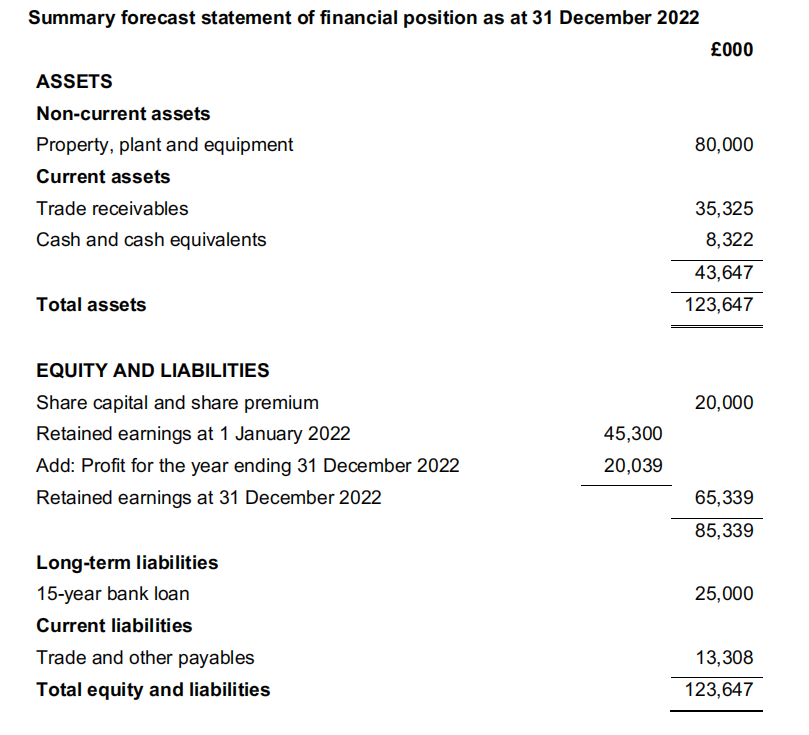

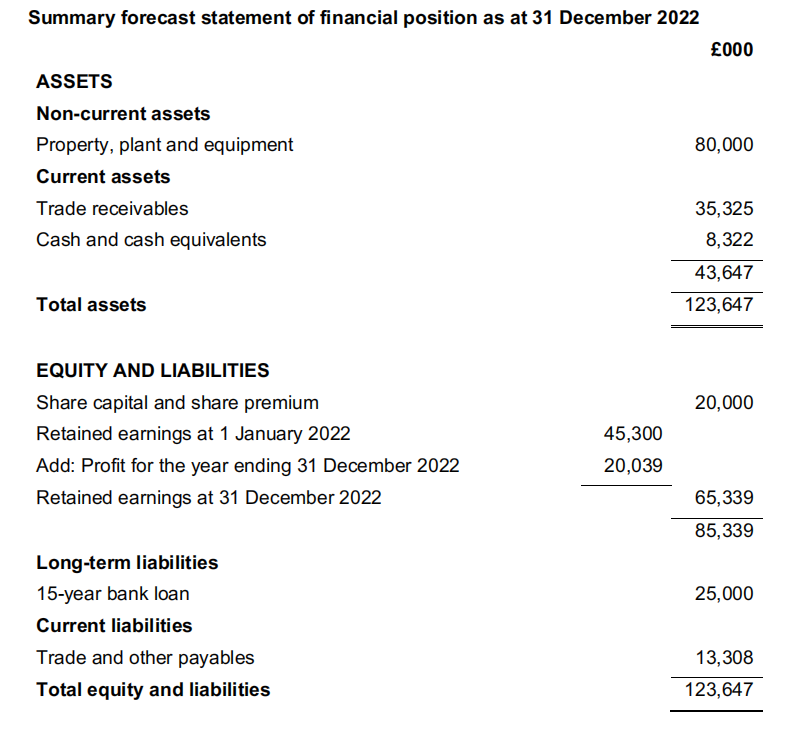

The CEO has provided you with the following summary projected statement of financial position:

REQUIRED:

a)

The CEO is unsure how to account for the £25 million bank loan and has included the arrangement fee of £250,000 in finance costs in the statement of profit or loss for the year ending 31 December 2022. The first cash interest payment for the loan for the year ending 31 December 2022 will be made on 1 January 2023.

No adjustments have been made for interest on the loan in the forecast financial statements for the year ending 31 December 2022.

i) Explain the possible IFRS treatment of bank loans. (630 words max., 14 marks)4

ii) Explain how ADVENT has incorrectly recorded the loan in its summary forecast financial statements for the year ending 31 December 2022. (270 words max., 6 marks) 会计税法代写

iii) Set out the appropriate financial reporting treatment of the £25 million loan in ADVENT’s summary forecast financial statements for the year ending 31 December 2022. Include correcting journal entries. (18 marks)

b)

Prepare a revised summary forecast statement of financial position for ADVENT for the year ending 31 December 2022 which includes your adjustments from a) above. (12 marks)

Total for PART B: 50 marks

Ignore any adjustments for taxation or deferred taxation.

更多代写:cs北美exam代考价格 代考gre 代写Essay英国 代写Essay技巧 澳大利亚微积分网课代考 诗歌论文代写