Drake & Scull International Financial analysis

Name

Institution affiliation

Course

Date

国际金融分析论文代写 It is evident from the financial analysis of the company that the organization is running at a profitability end, however, they are few issues

Table of Contents 国际金融分析论文代写

Introduction…………………………………………………………………………………………………….2

Financial Statement of Drake & Scull International……………………………………………..3

Income Statement…………………………………………………………………………………………….3

Balance sheet…………………………………………………………………………………………………..4

Statement of Cash Flows…………………………………………………………………………………..6

Profitability Ratios……………………………………………………………………………………………7

Profitability Ratios Analysis:……………………………………………………………………………..8

Liquidity Ratios……………………………………………………………………………………………….9

Liquidity Ratios Analysis:…………………………………………………………………………………10

Solvency Ratios……………………………………………………………………………………………….11

Solvency Ratios analysis:…………………………………………………………………………………12

Trend Analysis………………………………………………………………………………………………..12

Vertical Trend Analysis……………………………………………………………………………………13

Horizontal Trend Analysis……………………………………………………………………………….13

Inventories and records receivables stay unimportant……………………………………….14

Vertical and Horizontal Trend Analysis Commentary: Statement of Comprehensive Income…………………………………………………………………………………………………………15

Quality of Earnings” using Cash flow performance, in particular the operating cash flow……………………………………………………………………………………………………………..16

Recommendation………………………………………………………………………………………….17

Conclusion……………………………………………………………………………………………………17

References……………………………………………………………………………………………………18

Introduction

Drake & Scull International is a coordinated end-to-end administration supplier in the field of electrical and mechanical designing and has given imaginative answers for clients since its initiation in 1966. The company has skills in mechanical, electrical and plumbing (MEP) contracting compasses from giving complete arrangements through Design and Build to Engineering, Procurement and Construction (EPC), and upkeep and operations of Region Cooling Plants, and common contracting administrations crosswise over Dubai and Abu Dhabi. DSI has finished numerous prestigious ventures in the Emirates. The majority of our administrations are supported with in excess of 100 years of experience. Our Integrated Management Systems, guaranteed to ISO 9001:2000, guarantee full agreeability with building, wellbeing and security regulations, and sound ecological and vitality administration methodology. The this paper address the financial performance of the company in order to determine its reliability in the industry as well as in United Arab Emirates as a whole.

译文:

介绍 国际金融分析论文代写

Drake & Scull International 是电气和机械设计领域的端到端协调管理供应商,自 1966 年成立以来,一直为客户提供富有想象力的答案。该公司拥有机械、电气和管道 (MEP) 承包指南针的技能从设计和建造到工程、采购和施工 (EPC) 的完整安排,以及区域冷却厂的维护和运营,以及迪拜和阿布扎比交叉的共同承包管理部门。 DSI 在阿联酋完成了许多著名的项目。我们的大多数政府部门都拥有超过 100 年的经验。我们的综合管理系统符合 ISO 9001:2000 标准,保证完全符合建筑、健康和安全法规以及健全的生态和活力管理方法。本文介绍了该公司的财务业绩,以确定其在行业以及整个阿拉伯联合酋长国的可靠性。

Financial Statement of Drake & Scull International

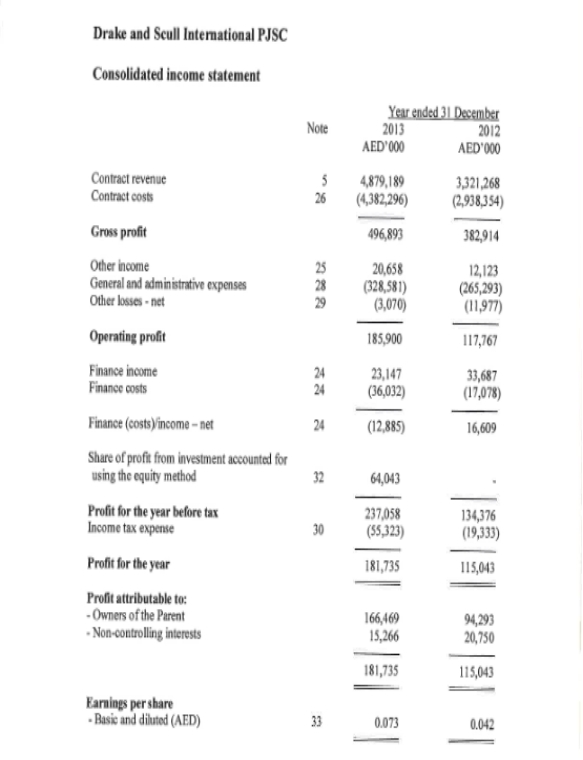

Income Statement

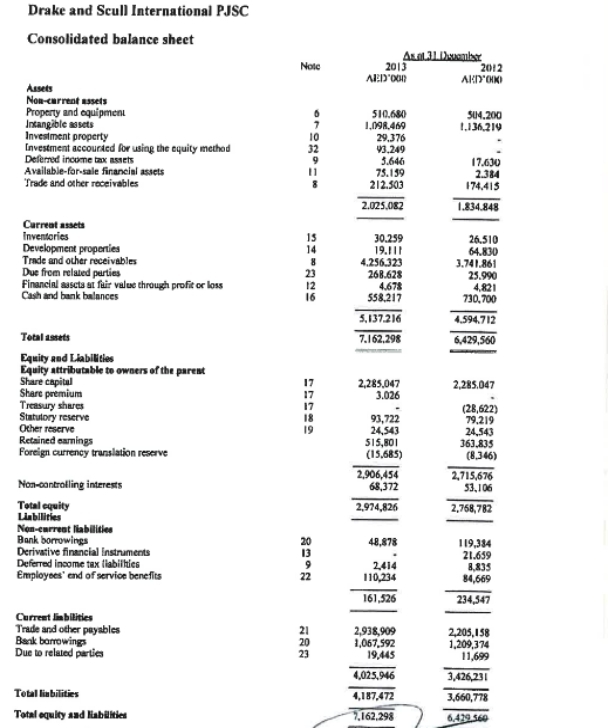

Balance sheet

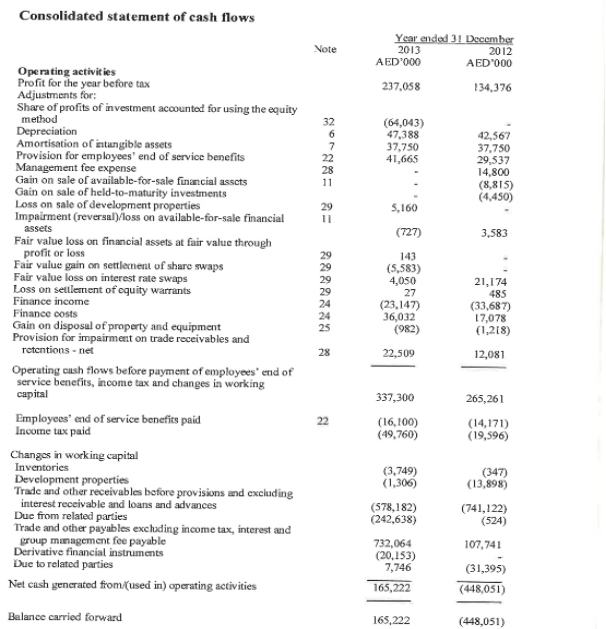

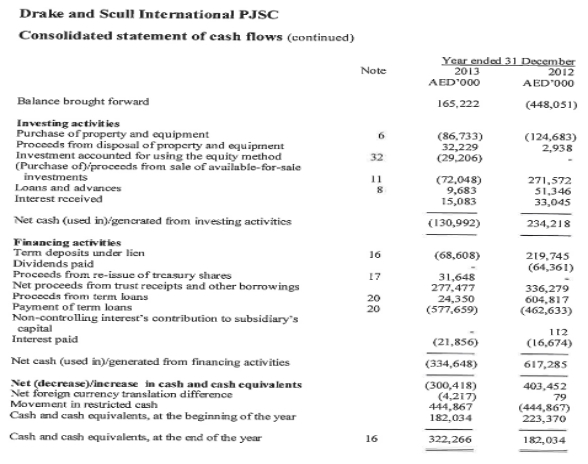

Statement of Cash Flows

Profitability Ratios

A profitability ratio is a measure of benefit, which is an approach to gauge an organization’s execution. Benefit is just the ability to make a benefit, and a benefit is what is left over from income earned after you have deducted all expenses and costs identified with acquiring the income (Johnson et al,. 2005). Regular profitability ratios utilized as a part of breaking down an organization’s execution include: net revenue, return on assets, and return on equity. Likewise we utilized EPS to quantify benefit. 国际金融分析论文代写

| Profitability Ratios | 2013 | 2012 |

| Net profit margin= net income/sales | 0.34 | 0.17 |

| Operating return on asset=net operating income /total Assets | 0.059 | 0.027 |

| Return on equity= Net income after taxes/stockholders equity | 0.021 | 0.005 |

| EPS | Fils 1.34 | Fils 0.34 |

译文:

盈利比率 国际金融分析论文代写

盈利率是衡量收益的一种方法,它是衡量组织执行情况的一种方法。 收益只是获得收益的能力,而收益是在扣除与获得收入相关的所有费用和成本后所赚取的收入所剩下的部分(Johnson 等人,2005 年)。 用作分解组织执行的一部分的常规盈利比率包括:净收入、资产回报率和股本回报率。 同样,我们使用 EPS 来量化收益。

| 盈利比率 | 2013 | 2012 |

| 净利润率 = 净收入/销售额 | 0.34 | 0.17 |

| 营业资产收益率=营业净收入/总资产 | 0.059 | 0.027 |

| 股本回报率=税后净收入/股东权益 | 0.021 | 0.005 |

| 每股收益 | Fils 1.34 | Fils 0.34 |

Profitability Ratios Analysis:

As indicated on the ratios figured over the net profit margin demonstrates how quite a bit of every deal AED appears as net salary after all costs are paid. For year 2012 the net revenue is 17 % that implies that the organization created 0.17 fils for each one AED of offers after all costs were represented. For year 2013 the net revenue is 0.34% that implies that 0.34 fils of each AED is benefit so the organization make a decent net overall revenue in 2013 than 2012. 国际金融分析论文代写

Operating return on asset measures the proficiency with which the Drake & Scull International is dealing with its interest in resources and utilizing them to create benefit. It gauges the measure of benefit earned with respect to the Drake & Scull International’s level of interest altogether resources. On 2012 is (2.7%) yet in 2013 is (5.9%) the higher is the best which is 2013, on the grounds that that implies the Drake & Scull International is making a decent showing utilizing its advantages for sales transactions.

译文:

盈利比率分析:

正如对净利润率计算的比率所示,在支付所有成本后,每笔交易 AED 中有相当多的部分显示为净工资。 2012 年的净收入为 17%,这意味着在表示所有成本后,该组织为每 1 个 AED 报价创建了 0.17 fils。 2013 年的净收入为 0.34%,这意味着每个 AED 的 0.34 fils 是收益,因此该组织在 2013 年的净总收入比 2012 年可观。

资产运营回报率衡量 Drake & Scull International 处理其对资源的兴趣并利用它们创造利益的熟练程度。它衡量了与 Drake & Scull International 的兴趣总资源水平相关的收益衡量标准。 2012 年为 (2.7%),而 2013 年为 (5.9%) 较高是最好的,即 2013 年,理由是这意味着 Drake & Scull International 正在利用其销售交易优势取得不错的表现。

Return on equity is the most vital of all the budgetary degrees to speculators in the organization.

It quantifies the profit for the cash the speculators have put into the organization. This is the degree potential financial specialists take a gander at when choosing whether or not to put resources into the Drake & Scull International. So we saw in 2012 0.5% and in 2013 2.1% it expanded. So it urge financial specialists to contribute on Drake & Scull International. It demonstrates that the organization is making a decent showing utilizing the financial specialists’ cash (Gertler & Kiyotaki, 2010).国际金融分析论文代写

EPS indicated that quality’s EPS for the year 2012 is Fils 0.34. This implies that if quality dispersed each AED of salary to its shareholders, each one offer would get 0.34 fils. EPS for the year 2013 is Fils 1.34. This implies that if quality dispersed each AED of pay to its shareholders, each one offer would get 1.34 Fils so in 2013 is more to 2012.

译文:

对组织中的投机者来说,在所有预算学位中,股本回报率是最重要的。

它量化了投机者投入该组织的现金的利润。 这是潜在的金融专家在选择是否将资源投入 Drake & Scull International 时所考虑的程度。 所以我们看到 2012 年增长了 0.5%,2013 年增长了 2.1%。 因此,它敦促金融专家为 Drake & Scull International 做出贡献。 它表明该组织正在利用财务专家的现金做出不错的表现(Gertler 和 Kiyotaki,2010 年)。

EPS 表明质量公司 2012 年的 EPS 为 Fils 0.34。 这意味着,如果质量将每一 AED 的薪水分配给其股东,则每个报价将获得 0.34 fils。 2013 年每股收益为 Fils 1.34。 这意味着,如果质量将每一 AED 的薪酬分配给其股东,则每一项要约将获得 1.34 Fils,因此 2013 年比 2012 年更多。

Liquidity Ratios 国际金融分析论文代写

Are the ratios that measure the capacity of an organization to reach its fleeting obligation commitments? These ratios measure the capacity of an organization to pay off its fleeting liabilities when they fall due. Common Liquidity ratios are current ratio, quick ratio, Average collection period, AR turnover, Inventory Turnover, Working capital and cash flow /sales.

| Liquidity Ratios | 2013 | 2012 |

| Current ratio = current asset/current liabilities | 1.276 国际金融分析论文代写 | 1.341 |

| Acid test ratio = current asset-inventory/current liability | 1.542 | 1.321 |

| Average collection period = AR/annual sale/365 | 17.214 | 3.923 |

| AR turnover = annual sale/ average AR | 1.221 | 0.732 |

| Inventory Turnover = COGS/average Inventory | 72.614

|

40.611

|

| Working capital = Current Assets/Current Liabilities | 1,111,270 国际金融分析论文代写 | 1,168,481 |

| Operating Cash Flow/Sales | 0.126 | 0.003 |

| Investing Cash Flow / sale | 0.086 | 0.009 |

| Financing Cash Flow / sale | 0.059 | -0.101 |

译文:

流动性比率

这些比率是衡量一个组织实现其转瞬即逝的义务承诺的能力吗? 这些比率衡量组织在其到期时偿还其流动负债的能力。 常见的流动比率是流动比率、速动比率、平均收款期、应收账款周转率、库存周转率、营运资金和现金流/销售额。

| 流动性比率 | 2013 | 2012 |

| 流动比率=流动资产/流动负债 | 1.276 | 1.341 |

| 酸性测试比率=流动资产-存货/流动负债 | 1.542 | 1.321 |

| 平均收款期 = 应收账款/年销售额/365 | 17.214 | 3.923 |

| 应收账款营业额 = 年销售额/平均应收账款 | 1.221 | 0.732 |

| 库存周转率 = COGS/平均库存 | 72.614

|

40.611

|

| 营运资金 = 流动资产/流动负债 | 1,111,270 | 1,168,481 |

| 经营现金流/销售额 | 0.126 | 0.003 |

| 投资现金流/销售 | 0.086 | 0.009 |

| 融资现金流/销售 | 0.059 | -0.101 |

Liquidity Ratios Analysis:

Current ratio when translating the current ratio of Drake & Scull International, I can see that Drake & Scull International Company had 1.341 AED in current assets for each AED it owed in current liabilities. The current assets enhanced in 2013 to 1.276 times. Along these lines, The Drake & Scull International Company would be advised to cash related position on 2013 than 2012

Acid test ratio known as quick ratio the ability for Drake & Scull International to utilize its quick resources (cash, cash equivalents and attractive securities) to pay its present liabilities on 2013 is 1.542 is superior to 2012, which are 1.321.国际金融分析论文代写

The current ratio and quick ratio 2013 and 2012 are similar, so I use vertical analyze to see the reason. I found that Inventory it cover 0.03% of current asset in 2013 and in 2012 it cover 0.13% so, it not affect too much on convert current asset to cash in one accountant period.

Average collection period the normal number of days it takes the Drake & Scull International to change over receivables into money on 2012 was 3.923 is quicker and better than 2013 which was 17.214 days.

译文:

流动性比率分析: 国际金融分析论文代写

流动比率 在转换 Drake & Scull International 的流动比率时,我可以看到 Drake & Scull International 公司的流动资产为 1.341 AED,其流动负债中每欠 AED。 2013年流动资产增至1.276倍。按照这些思路,德雷克和斯卡尔国际公司将被建议在 2013 年兑现相关头寸而不是 2012 年

酸性测试比率称为速动比率,Drake & Scull International 利用其快速资源(现金、现金等价物和有吸引力的证券)支付其现时负债的能力在 2013 年为 1.542,优于 2012 年的 1.321。

2013 年和 2012 年的流动比率和速动比率相似,所以我使用垂直分析来查看原因。我发现库存在2013年占流动资产的0.03%,在2012年占0.13%,因此,它对一个会计期间的流动资产转换为现金没有太大影响。

2012 年 Drake & Scull International 将应收账款转换为货币所需的正常天数的平均收款期为 3.923 天,比 2013 年的 17.214 天更快且更好。

AR turnover as should be obvious, Drake & Scull International’s turnover is 0.732 in 2012 and 1.221 in 2013.

This implies that Drake & Scull International gathers his receivables around 1.221 times each year or once like clockwork in 2012 and around 1.221 times each year or once at regular intervals in 2013. As it were, when Drake & Scull International makes a credit deal, it will take him 100 days to gather the trade from that deal in for spendable dough 2012 and 56 days in 2013 that is better.

Inventory Turnover a higher estimation of stock turnover 72.614 demonstrates preferable execution in 2013 over the lower estimation of 40.611 wastefulness in controlling stock levels in 2012. 国际金融分析论文代写

Working capital a Drake & Scull International’s capacity to pay off its present liabilities with current resources are useful for the two years on the grounds that it is less 1 yet 2013 is more superior to 2012.

Operating Cash Flow/Sales a Drake & Scull International’s capacity to change over deals into trade in for money 2013 was 0.126 is superior to 2012 which was 0.003.

Investing Cash Flow / Sale Company offer altered resources, trade comes in for money from the deal in 2013 is 0.086 is superior to 0.009 in 2012. 国际金融分析论文代写

Financing Cash Flow / sale outside exercises of 2013 it permit Drake & Scull International Company to raise capital and reimburse speculators, for example, issuing money profits, yet in 2012 the proportion is negative in light of the fact that Drake & Scull International Company acquire and reimburse obligation.

译文:

AR 营业额应该是显而易见的,DRAKE & SCULL INTERNATIONAL 的营业额在 2012 年为 0.732,在 2013 年为 1.221。

这意味着 Drake & Scull International 每年收取大约 1.221 次或 2012 年一次类似发条的应收账款,2013 年每年收取大约 1.221 次或定期收取一次。他将需要 100 天的时间来从这笔交易中收集交易以换取 2012 年的可消费面团,而在 2013 年则需要 56 天,这更好。

库存周转率 72.614 较高的库存周转率估计表明 2013 年的执行优于较低的 2012 年控制库存水平的 40.611 浪费估计。

营运资金 Drake & Scull International 用当前资源偿还当前负债的能力在两年内是有用的,因为它小于 1,但 2013 年比 2012 年更优越。

2013 年,Drake & Scull International 的经营现金流/销售能力将交易转换为以交易换取货币的能力为 0.126,优于 2012 年的 0.003。

投资现金流量/销售公司提供改变的资源,2013 年交易的交易收入为 0.086,优于 2012 年的 0.009。

2013 年的融资现金流量/外部销售允许 Drake & Scull International Company 筹集资金并偿还投机者,例如发行货币利润,但由于 Drake & Scull International Company 收购并在 2012 年该比例为负数偿还义务。

Solvency Ratios

Solvency ratios are designed to help us to measure the degree of financial risk that that the company faces by considering debt ratio, Times interest earned.

| Solvency Ratios | 2013 | 2012 |

| Debt ratio = Total liabilities/ total asset | 0.584 | 0.569 |

| Times interest earned = operating income/interest expense | 4.223 | 1.006 |

译文:

偿付能力比率 国际金融分析论文代写

偿付能力比率旨在帮助我们通过考虑债务比率、所获利息倍数来衡量公司面临的财务风险程度。

| 偿付能力比率 | 2013 | 2012 |

| 负债率=总负债/总资产 | 0.584 | 0.569 |

| 所获利息乘以营业收入/利息支出 | 4.223 | 1.006 |

Solvency Ratios analysis:

Debt ratio, Drake & Scull International just has an obligation degree of 0.195 in 2012 and 0.584 in 2013. As it were, Drake & Scull International has 0.569 times the same number of benefits as it has liabilities in 2012 and in 2013 it has 0.210 times the same number of advantages as it has liabilities. This is a generally low proportion and infers that Drake & Scull International will have the capacity to pay back his advance in both 2012 and 2013. Drake & Scull International shouldn’t have an issue getting affirmed for his credit. 国际金融分析论文代写

Times interest earned 1.006 times an organization could pay the enthusiasm with its before assessment salary in 2012 yet the organization make 4.223 times an organization could pay the enthusiasm with its before duty wage in 2013, so clearly the bigger proportions of 2013 are viewed as more great than littler degrees of 2012.

Vertical Analysis

| 2012 | % | |

| Total Non-current asset | 1,834,848 | 28.5% |

| Inventories | 26,510 | 0.4% |

| Development properties | 64,830 | 1% |

| Trade and other receivables | 3,741,861 国际金融分析论文代写 | 58% |

| Due from related parties | 25,990 | 0.4% |

| Financial assets at fair value | 4,821 | 0.07% |

| Cash and bank balance | 730,700 | 11.3% |

| Total assets | 6,429,560 | 100% |

译文:

偿付能力比率分析:

债务比率,Drake & Scull International 2012 年的义务度为 0.195,2013 年为 0.584。实际上,Drake & Scull International 2012 年的收益是负债的 0.569 倍,2013 年是 0.210 倍与负债相同数量的优势。这是一个普遍较低的比例,并推断 Drake & Scull International 将有能力在 2012 年和 2013 年偿还他的预付款。Drake & Scull International 的信用应该没有问题。

2012年利息所得利息是企业用考核前工资支付积极性的1.006倍,而2013年企业用税前工资支付积极性的利息是4.223倍,所以很明显2013年的比例越大越好比 2012 年的度数低。

纵向分析

| 2012 | % | |

| 非流动资产总额 | 1,834,848 | 28.5% |

| 库存 | 26,510 | 0.4% |

| 发展物业 | 64,830 | 1% |

| 贸易及其他应收款 | 3,741,861 国际金融分析论文代写 | 58% |

| 关联方欠款 | 25,990 | 0.4% |

| 公允价值的金融资产 | 4,821 | 0.07% |

| 现金和银行余额 | 730,700 | 11.3% |

| 总资产 | 6,429,560 | 100% |

Trend Analysis

The trend analysis involves both a vertical and horizontal investigation proposed to highlight critical changes in the Drake & Scull International’s money related structure and execution amid the 2012-2013 monetary periods under audit (Gertler & Kiyotaki, 2010).

译文:

趋势分析

趋势分析涉及纵向和横向调查,旨在突出 Drake & Scull International 的货币相关结构和执行在 2012-2013 年审计期间的重大变化(Gertler & Kiyotaki,2010 年)。

Vertical Trend Analysis

It is clear that the company’s balance sheet is dominated by Goodwill (non-current assets) and records receivables as present assets. Resource equalizations have been steady over the period. By and large non-current assets have imperceptibly expanded by 11.3%, the increment can be ascribed to increment in Derivative budgetary instruments. Current assets have likewise remained moderately steady despite the fact that the negative supporting store has possibly contorted this extent toward the end of 2013. Non-current liabilities have declined to 0.4% because of an abatement in the budgetary liabilities, which is because of the renaming of obligation to current risk.

译文:

垂直趋势分析 国际金融分析论文代写

很明显,该公司的资产负债表以商誉(非流动资产)为主,并将应收账款记录为现时资产。 在此期间,资源均等化一直稳定。 总的来说,非流动资产不知不觉地增长了 11.3%,这种增长可以归因于衍生预算工具的增长。 尽管到 2013 年底,负面支持可能会扭曲这种程度,但流动资产同样保持适度稳定。 由于预算负债的减少,非流动负债下降至 0.4%,这是因为更名 承担当前风险的义务。

Horizontal Trend Analysis

| 2013 | 2012 | Inc./(dec.) | Inc/(dec) | |

| Changes AED | Change% | |||

| Revenue | AED 3,321,268 | AED 3,109,618 | AED 211,650 | 6.8% |

| Operating income | AED 117,621 | AED 182,211 | AED 64,590 | 35% |

The base year always 100% I chose 2012 as my based year 国际金融分析论文代写

| 2013 | 2012 | 2011 | |

| Revenue | 179% | 167% | 100% |

| operating income | 71% | 110% | 100% |

The horizontal trend analysis demonstrates a relentless non-current resource figure with a real development in Derivative monetary instruments. Counseling the notes uncovers that, the Group uses subsidiary money related instruments for supporting purposes in regards to its presentation to premium rate dangers emerging from financing operations. Subsequently, money stream fences of premium rate danger are perceived specifically in value, an increment in material parcel is perceived in the solidified proclamation of salary. Current resource levels have likewise stayed stable, however increment in

译文:

横向趋势分析

| 2013 | 2012 | 公司/(十二月) | 增量/(十二) | |

| 更改 AED | 改变% | |||

| 收入 | AED 3,321,268 | AED 3,109,618 | AED 211,650 | 6.8% |

| 营业收入 | AED 117,621 | AED 182,211 | AED 64,590 | 35% |

基准年总是 100% 我选择 2012 作为基准年 国际金融分析论文代写

| 收入 | 179% | 167% | 100% |

| 营业收入 | 71% | 110% | 100% |

横向趋势分析显示了衍生货币工具的真实发展的无情的非流动资源数据。 咨询票据发现,本集团使用附属货币相关工具来支持其呈报融资业务产生的溢价风险。 随后,溢价率危险的资金流围栏在价值上被具体感知,在工资的固化公告中感知到物质包的增加。 目前的资源水平同样保持稳定,但增加

Inventories and records receivables stay unimportant.

Looking at shareholders equity, the figure has remained moderately steady inferring that no noteworthy capital financing has occurred. This can be credited the misfortunes perceived in the supporting store, however not fiscally critical. These misfortunes come as an aftereffect of revaluations of budgetary instrument that were weakened because of the 2012/2013 monetary retreat. For the most part, non-current liabilities have declined particularly money related liabilities which, have fallen over the periods in spite of the fact that there has been an ascent in subsidiary adjusts a sort of monetary instrument yet these are inconsequential in budgetary terms. 国际金融分析论文代写

Current liabilities on the other hand have decreased; a zone of change is in transient budgetary liabilities. Be that as it may, further examination is needed from the notes to the records to give more clarification. The other decline in the payables parities, however this is additionally reflected in diminishing receivables and money equalizations showing that the Drake & Scull International is getting to be more effective in dealing with its credit. Hence, the Drake & Scull International’s a thorough examination of the announcement of position uncovers no critical structural changes in its budgetary position.

译文:

库存和记录应收账款仍然不重要。

从股东权益来看,该数字保持适度稳定,表明没有发生值得注意的资本融资。这可以归功于在支持商店中感受到的不幸,但在财政上并不重要。这些不幸是由于 2012/2013 年货币撤退而削弱的预算工具重估的后果。在大多数情况下,非流动负债下降,尤其是与货币相关的负债,这些负债在一段时间内下降,尽管附属调整了一种货币工具,但这些在预算方面是无关紧要的。

另一方面,流动负债有所减少;一个变化区域是临时预算负债。尽管如此,还需要从注释到记录进行进一步检查以提供更多说明。应付账款平价的另一个下降,然而,这也反映在应收账款的减少和货币均等化上,这表明 Drake & Scull International 在处理其信贷方面变得更加有效。因此,Drake & Scull International 对职位公告的彻底检查没有发现其预算职位的重大结构性变化。

Vertical and Horizontal Trend Analysis Commentary: Statement of Comprehensive Income

It is clear that, the company’s revenues are expanding showing that the business sector is growing. This is additionally can be underpinned by diminishing expense of offers. In as much as working costs have marginally diminished in 2012 this can be ascribed, working benefits has been cured by administration and stays to be moderately. 国际金融分析论文代写

With regard to exceptional items, the Group holds various empty and mostly sub-let leasehold properties. As esteemed fundamental, procurements have been made for leftover lease duties. This is carried out in the wake of considering existing and expected sub-inhabitant game plans. In 2012, current and expected sub-occupant plans credited to a huge increment in the procurement which takes a significant allotment of the extraordinary things.

Therefore for 2012, outstanding figures of AED3.3m were ascribed to Builders Merchants, while AED 3.1m were attributable to Retail rents. Structure the money related articulations, absolute remarkable figures are included again for the figuring of balanced benefit, basically working benefit before excellent things. Along these lines, it is paramount to note that benefits for 2012 and 2013 are essentially influenced by uncommon charges. Then again, the general fundamental pattern shows recouping benefit particularly after a recessionary period saw in 2013 as an aftereffect of the worldwide financial emergency

译文:

纵向和横向趋势分析评论:综合收益表

很明显,该公司的收入正在扩大,表明该业务部门正在增长。这也可以通过减少报价的费用来支持。由于工作成本在 2012 年略有下降,这可以归因于,工作福利已被行政部门治愈并保持适度。

就特殊项目而言,本集团持有各种空置且大部分转租的租赁物业。作为受人尊敬的基本原则,已为剩余的租赁税进行采购。这是在考虑现有和预期的亚居民游戏计划之后进行的。 2012 年,当前和预期的分租计划归功于采购的巨大增量,这需要大量分配非凡的东西。

因此,在 2012 年,330 万迪拉姆的未付数字归因于建筑商,而 310 万迪拉姆归因于零售租金。构建与金钱相关的关节,为了平衡利益的计算,再次包括绝对显着的数字,基本上是工作利益在优秀事物之前。沿着这些思路,最重要的是要注意 2012 年和 2013 年的收益主要受到不寻常费用的影响。再说一次,一般的基本模式显示出复苏的好处,特别是在 2013 年作为全球金融紧急情况的后遗症出现的衰退期之后

Quality of Earnings” using Cash flow performance, in particular the operating cash flow.

Higher quality income all the more reliably speak to the peculiarities of the company’s central profit prepare that are applicable to a particular choice settled on by a particular chief. Our definition suggests that the expression income quality is aimless without indicating the choice connection, in light of the fact that the significant gimmicks of the company’s basic profit procedure contrast crosswise over decisions and managers. Quality of earning via the use of an operating cash flow is precise in light of the fact that clarify it in subtle elements, significant to other monetary explanations by utilizing notes, practically identical to earlier year.

| 国际金融分析论文代写 | 2013 AED’ 000 | 2012 AED’000 |

| Profit for the year adjustment for | 154,517 | 38605. |

| Depreciation [Note 5] | 3,479 | 6,399 |

| Provision for employees benefits | 1,845 | 2,476 |

| Provision for doubtful debts [note 24] | 2,716 | 9,721 |

| Provision for Impairment of properties held | 104 | 67,169 |

| Gain on disposal of subsidiary | 27.6791 | 1276 |

Finance Income [note 26] |

55111 | 47I1 |

| Finance Costs [Note 26] | 4315 | 8,244 |

| Share of Results from association Joint Ventures[Note 8] | 14244 | 7,683 |

| Gain on fair valuation of investment property [note 5] | 494,691 | 126,411 |

| Loss on disposal of investment in joint venture [note 8] | 76,283 | 3200 |

| Gain on disposal of property and Equipment | 210 | 2061 |

| Operating cash flows | 108,998 | 172242 |

| Payment of employees | 12,161 | 1154 |

| Trade and other payables | 4,076 | 1,934 |

| Net cash generated from operating activities | 920429 | 459,076 |

译文:

收益质量”使用现金流表现,特别是经营现金流。

更高质量的收入更可靠地说明了公司中央利润准备的特点,这些特点适用于由特定负责人决定的特定选择。我们的定义表明,收入质量的表述是漫无目的的,而没有表明选择的联系,因为公司基本盈利程序的重要噱头在决策和管理者之间形成了交叉对比。通过使用经营现金流量的收益质量是精确的,因为它在微妙的元素中澄清,通过使用票据对其他货币解释很重要,实际上与前一年相同。

| 2013 AED’ 000 | 2012 AED’000 | |

| 年度利润调整 | 154,517 | 38605. |

| 折旧 [注 5] | 3,479 | 6,399 |

| 雇员福利的规定 | 1,845 | 2,476 |

| 呆账拨备 [附注 24] | 2,716 | 9,721 |

| 持有财产的减值准备 | 104 | 67,169 |

| 出售附属公司的收益 | 27.6791 | 1276 |

财务收入 [附注 26] |

55111 | 47I1 |

| 财务费用 [附注 26] | 4315 | 8,244 |

| 协会合资企业的业绩分享[注8] | 14244 | 7,683 |

| 投资物业公平估值的收益 [附注 5] | 494,691 | 126,411 |

| 出售合营企业投资亏损 [附注 8] | 76,283 | 3200 |

| 处置财产和设备的收益 国际金融分析论文代写 | 210 | 2061 |

| 经营现金流 | 108,998 | 172242 |

| 员工工资 | 12,161 | 1154 |

| 贸易及其他应付款项 | 4,076 | 1,934 |

| 经营活动产生的现金净额 | 920429 | 459,076 |

Recommendation

This project of mine had to get into the financial statements of Drake & Scull International in order to gain clear understanding of the financial analysis of the company in order to gain more insights about the company’s reliability. Therefore, the company has to come on board and use such financial analysis to determine its profitability and performance.

译文:

推荐 国际金融分析论文代写

我的这个项目不得不进入Drake & Scull International的财务报表,以便清楚地了解公司的财务分析,从而更深入地了解公司的可靠性。 因此,公司必须加入并使用此类财务分析来确定其盈利能力和业绩。

Conclusion

It is evident from the financial analysis of the company that the organization is running at a profitability end, however, they are few issues in its financial reliability that has not been addressed. The company has been having an outstanding performance over 2012 and 2013 as indicated by the ratio, vertical and horizontal analysis. In order to gain future success in the industry, the company should diversify its sales.

译文:

结论 国际金融分析论文代写

从公司的财务分析中可以明显看出,该组织正在以盈利为目标运行,但是,其财务可靠性方面的问题很少没有得到解决。 2012年和2013年公司业绩表现突出,从比率、纵向和横向分析可见一斑。 为了在未来在行业中取得成功,公司应该实现销售多元化。

References 国际金融分析论文代写

Gertler, M., & Kiyotaki, N. (2010). Financial intermediation and credit policy in business cycle analysis. Handbook of monetary economics, 3(11), 547-599.

Revsine, L., Collins, D. W., Johnson, W. B., Collins, D. W., & Johnson, W. B. (2005). Financial reporting & analysis. New York, NY: Pearson/Prentice Hall.

Shaoul, J. (2005). A critical financial analysis of the Private Finance Initiative: selecting a financing method or allocating economic wealth?. Critical Perspectives on Accounting, 16(4), 441-471.

其他代写:代写CS C++代写 java代写 matlab代写 web代写 app代写 作业代写 物理代写 数学代写 考试助攻 r代写 金融经济统计代写 paper代写 finance代写