Investments

Problem Set 5

温哥华金融代考 If markets are efficient, the correlation coefficient between stock returns for two non-overlapping time periods should be zero.

True-False (plus reasons; I am expecting no more than two-three sentences for each): 温哥华金融代考

1.If markets are efficient, the correlation coefficient between stock returns for two non-overlapping time periods should be zero.

2.If markets are semi-strong form efficient, the following are viable strategies to earn abnormally high trading profits.

a.Buy shares in companies with low P/E ratios

b.Buy shares in companies with recent above-average price changes

c.Buy shares in companies for which you have advance knowledge of an improvement in management team

3.If the business cycle is predictable, and a stock has a positive beta, the stock’s (abnormal) returns also must be predictable

4.The following are consistent with efficient market hypothesis

a.Nearly half of all professionally managed mutual funds are able to outperform the S&P 500 in a typical year

b.Money managers that outperform the market (on a risk-adjusted basis) in one year are likely to outperform in the following year

c.Stock prices tend to be predictably volatile in January than in other months

d.Stock prices of companies that announce increased earnings in January tend to outperform the market in February

e.Stocks that perform well in one week perform poorly in the following week

Questions 温哥华金融代考

- The monthly rate of return in T-bills is 1%. The market went up this month by 1.5%. In addition, AmbChaser, Inc., which has an equity beta of 2, surprisingly just won a lawsuit that awards it $1 million immediately.

a.If the original value of the equity were $100 million, what would you guess was the rate of return of its stock this month?

b.What is your answer to (a) if the market had expected AmbChaser to win $2min?

2.Investors expect the market rate of return in the coming year to be 12%.

The T-bill rate is 4%. Changing fortunes Industries’ stock has a beta of 0.5. The market value of its outstanding equity is $100 million.

a.What is your best guess currently as to the expected rate of return on Changing Fortunes’ stock? You believe the stock is fairly priced.

b.If the market return in the coming year actually turns out to be 10%, what is your best guess as to the rate of return that will be earned in Changing Fortunes’ stock? 温哥华金融代考

c.Suppose now that the company wins a major lawsuit during the year. The settlement is $5 million. The company’s stock return during the year turns out to be 10%. What is your best guess as to the settlement the market previously expected Changing Fortunes to receive from the lawsuit? (Continue to assume that the market return in the year turned out to be 10 %.) The magnitude of the settlement is the only unexpected firm-specific event during the year.

3.Suppose that during a certain week the Fed announces a new monetary growth policy, Congress surprisingly passes legislation restricting imports of foreign automobiles, and Ford comes out with a new car model that it believes will increase profits substantially. How might you go about measuring the market’s assessment of Ford’s new model?

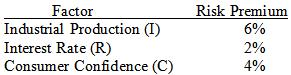

4.Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums

The return on a particular stock is generated according to the following equation:

r = 15% + 1.0I + 0.5R + 0.75C + e

(Note that I, R and C are shocks, so they have an expected value of zero)

Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 6%. Is the stock over or underpriced? Explain

5.Suppose that there are many stocks in the security market and that the characteristics of Stocks A and B are given as follows

| Stock | Expected Return | Standard Deviation |

| A | 10% | 5% |

| B | 15% | 10% |

| Correlation = -1 | ||

Suppose that it is possible to borrow at the risk-free rate, rf. What must be the value of the risk-free rate? 温哥华金融代考

6.Suppose that as the economy moves through a business cycle, risk premiums also change. For example, in a recession when people are concerned about their jobs, risk tolerance might be lower and risk premiums might be higher. In a booming economy, tolerance for risk might be higher and premiums lower.

a)Would a predictably shifting risk premium such as described here be a violation of the efficient market hypotheses?

b)How might a cycle of increasing and decreasing risk premiums create an appearance that stock prices “overreact”, first falling excessively and then seeming to recover?

7.Discuss the different limits to arbitrage.

8.Closed-end funds often sell for substantial discounts or premiums from net asset value. This is a violation of the Law of One Price, because one would expect the value of the fund to equal the value of the securities it holds. Would you expect to observe greater discrepancies on diversified or less-diversified funds? Equity market funds or Bond market funds? Why?