Problem Set Week 4

Purpose 资产管理课业代写

Try to solve the following set of problems related with contents explored in Week 4. Revisit the learning materials made available during Week 4.

Duration

Try to solve this set of problems in 50 minutes, maximum.

Exercise 1

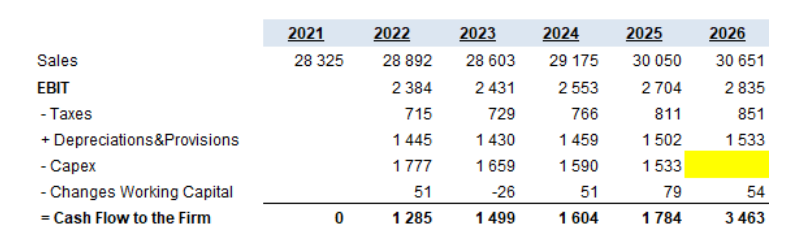

1.You are an asset manager valuing Company TXB which you are considering to eventually include in the equity component of your portfolio. After collecting information, you estimated the following items:

a)What should be the missing value for the 2026 expected capex? Justify your answer.

b)Calculate the Free Cash Flow to Firm of TXB for each year between 2022 and 2026.

2.Still regarding TXB, you have the additional assumptions and information: 资产管理课业代写

- Reference average risk free rate: 2%

- Target Debt/(Debt+Equity) ratio: 25%

- Expected average debt spread: 3%

- Reference Equity Risk premium: 6%;

- Equity Beta: 1.35;

- Long term inflation: 2%;

- Expected real growth of FCF in perpetuity: 0.5%.

- Expected TXB interest bearing debt at 2022 year end: €3.000.000;

- Expected TXB cash position at 2022 year end: €1.300.000;

- Expected TXB Financial Investments at 2022 year end: €2.750.000.

- TXB number of outstanding shares: 650.000.

- Current market price of TXB shares: €37/share.

- Corporate tax rate: 30%

a)Considering the CAPM model and the estimated capital structure of TXB, calculate the appropriate rate of discount of estimated FCF

b)Assuming the company has no expected life limit. What is the terminal value of TXB?

c)Calculate the Enterprise Value of TXB at year end 2022

d)Calculate the Equity Value of TXB at year end 2022

e)Considering current market price, what would be your investment decision regarding TXB?

Exercise 2 资产管理课业代写

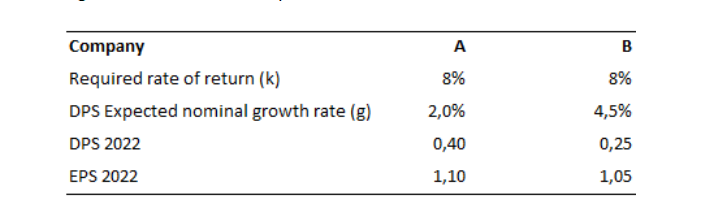

Consider the following information about Companies A and B

(DPS stands for Dividends per share and EPS stands for Earnings per share)

- What is the Price-Earnings multiple of each company?

- Considering the obtained figures, as an asset manager would you feel comfortable to say that one company is relatively cheaper than other? Justify qualitatively and quantitatively your answer.

更多代写:cs华盛顿特区网课代上 GMAT online作弊 英国行为组织学作业代写 海外论文代写机构 代写留学申请 资产管理期中代考