Ac.F 302 CORPORATE FINANCE

企业财务代写 Section A Section A consists of Questions 1 to 10. Answer ALL questions in this section. 1) Which of the following statements is FALSE?

(DURATION: 2.5 HOURS plus 30 minutes upload time)

Answer ALL questions from Section A.

Answer ONE question from Section B. Answer ONE question from Section C.

A table with the cumulative probabilities of the standard normal distribution is

included at the end of the examination paper.

This exam is open-book.

Section A 企业财务代写

Section A consists of Questions 1 to 10. Answer ALL questions in this section.

1)

Which of the following statements is FALSE?

- When a company’s borrowing to finance a project is set according to apredetermined schedule, the interest tax shields on this debt should be discounted using the unlevered cost of capital.

- With a constant interest coverage policy, the value of the interest tax shield is proportional to the project’s levered value.

- A target leverage ratio means that the firm adjusts its debt proportionally to the project’s market value.

- Debentures usually contain clauses restricting the company from issuing new debt with equal priority to existing debt.

A) Statement 1.

B) Statement 2.

C) Statements 1 and 3.

D) Statements 1 and 2.

2) 企业财务代写

Which of the following is an IPO puzzle?

A) On average, IPOs appear to be overvalued.

B) New public companies perform worse than the market over the long run.

C) The fee percentage charged by underwriters is sensitive to issue size.

D) Economic conditions fully explain the time-series fluctuations in the number of IPOs.

3)

Which of the following statements is FALSE?

- In the flow-to-equity valuation method, the project’s free cash flows are discounted using the equity cost of capital.

- When a firm has permanent debt, the cost of debt is not required to calculate the present value of the interest tax shield.

- Eurodollar bonds are issued by foreign (non-U.S.) companies in the U.S. bond market.

- Private companies usually issue preferred stock when they sell equity for the first time to outside investors.

A) Statement 3.

B) Statement 2 and 3.

C) Statements 1 and 3.

D) Statements 2 and 4.

4) 企业财务代写

Which of the following about foreign corporate bonds is TRUE?

A) They are denominated in the currency of the borrower’s country.

B) They are issued and traded in countries other than the country in which the bond’s currency is denominated.

C) They are aimed for investors from the same country as the borrower.

D) A bond issued by non-British companies seeking to raise capital in pound-sterling from British investors is an example of a foreign corporate bond.

5)

When a holder of a ________ exercises it and purchases stock, this dilutes the ownership of existing shareholders.

A) call option.

B) callable bond.

C) warrant.

D) preferred option.

6) 企业财务代写

Which of the following statements is FALSE?

A) A public warehouse is a business that exists for the sole purpose of storing and tracking the inflow and outflow of the inventory.

B) A warehouse arrangement is the riskiest collateral arrangement from the standpoint of the lender.

C) Because the warehouser is a professional at inventory control, there is likely to be little loss due to damaged goods or theft, which in turn lowers insurance costs.

D) A field warehouse is operated by a third party, but is set up on the borrower’s premises in a separate area so that the inventory collateralizing the loan is kept apart from the borrower’s main plant.

7)

Which of the following statements is FALSE?

A) When following a conservative financing policy, a firm would use long-term sources of funds to finance its fixed assets, permanent working capital, and some of its seasonal needs.

B) An aggressive financing policy also increases the possibility that managers of the firm will use excess cash nonproductively—for example, on perquisites for themselves.

C) A firm could finance its short-term needs with long-term debt, a practice known as a conservative financing policy.

D) To implement a conservative financing policy effectively, there will necessarily be periods when excess cash is available—those periods when the firm requires little or no investment in temporary working capital.

8) 企业财务代写

Which of the following statements regarding risk arbitrage is FALSE?

A) Once a tender offer is announced, the uncertainty about whether the takeover will succeed reduces the volatility of the stock price. This uncertainty creates an opportunity for investors to speculate on the outcome of the deal without bearing the risk of volatility.

B) Traders known as risk-arbitrageurs, who believe that they can predict the outcome of a deal, take positions based on their beliefs.

C) A potential profit arises from the difference between the target’s stock price and the implied offer price, and is referred to as the merger-arbitrage spread.

D) It is not true arbitrage because there is a risk that the deal will not go through. If the takeover did not ultimately succeed, the risk-arbitrageur would eventually have to unwind his position at whatever market prices prevailed.

9) 企业财务代写

Which of the following statements is FALSE?

A) The lease-equivalent loan is the loan that is required on the purchase of the asset that leaves the purchaser with the same obligations as the lessor would have.

B) Lease obligations themselves could trigger financial distress.

C) When a firm enters into a lease, it is committing to lease payments that are a fixed future obligation of the firm.

D) When a firm leases an asset, it is effectively adding leverage to its capital structure (whether or not the lease appears on the balance sheet for accounting purposes).

10)

Which of the following statements is FALSE?

A) On the other hand, by relying on short-term debt the firm exposes itself to funding risk, which is the risk of incurring financial distress costs should the firm not be able to refinance its debt in a timely manner or at a reasonable rate.

B) An ultra-conservative policy would involve financing even some of the plant, property, and equipment with short-term sources of funds.

C) With a conservative financing policy, the firm would use short-term debt very sparingly to meet its peak seasonal needs.

D) Short-term debt can have lower agency and lemons costs than long-term debt, and an aggressive financing policy can benefit shareholders.

(2 marks for each question)

(Total 20 marks)

Section B 企业财务代写

Answer EITHER Question 11 OR Question 12.

Answer all parts of the chosen question.

Question 11

a)

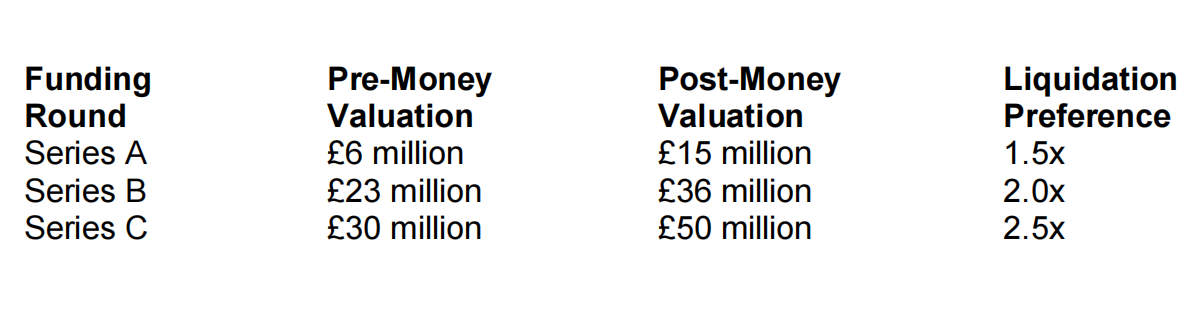

You are the founder of Swift Technologies. Your startup has raised capital as follows:

The table above shows the pre- and post-money valuations in each funding round and the liquidation preference of investors in each round. Series C investors have the highest seniority followed by Series B then Series A and then you (the founder). None of the financing rounds offered investors participation rights.

REQUIRED:

i. How much money did Swift raise in each round? (3 marks)

ii. Assuming you were the only shareholder prior to the Series A round, what percentage of the company do you own after each round? (3 marks)

iii. What is the distribution of ownership across investors after the Series C round (i.e., what percentage of the company do the investors from each round own)? (3 marks)

iv. Suppose that Swift wants to raise an additional £35 million in a new Series D funding round. What is the largest fraction of the firm that can be offered to new investors without leading to a down round? (4 marks)

v. Suppose instead that Swift is acquired after the Series C round. What is the minimum sale price such that you receive at least £10 million? (6 marks)

b)

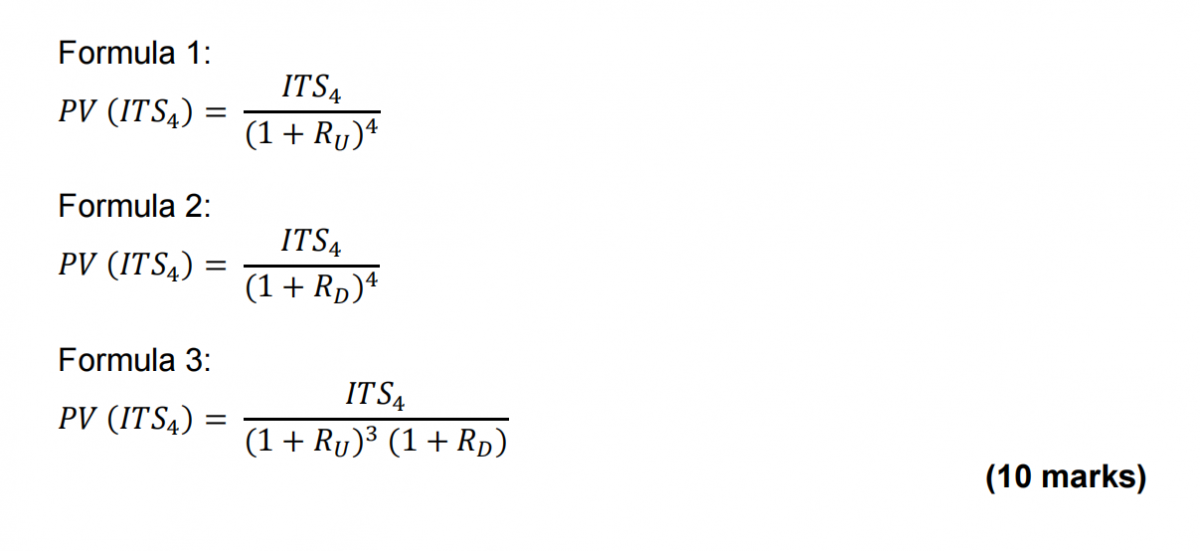

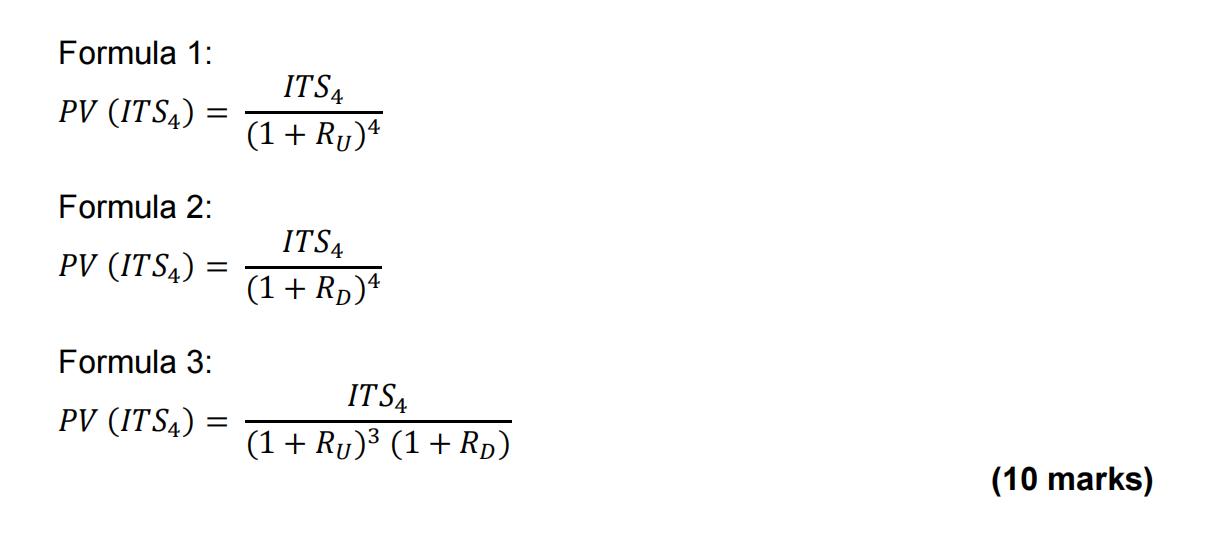

Suppose you want to calculate the present value of the final-year’s interest tax shield for a project that has a life of four years. When should each of the formulas below be used? Explain the rationale for using each formula.

c)

Sporting Cycles has come up with a new road bike prototype and is ready to go ahead with pilot production and test marketing. The pilot production and testmarketing phase will last for one year and cost £600,000 to be paid today. The management team believes that there is a 40% chance that the test marketing will be successful and that there will be sufficient demand for the new road bike. If the test-marketing phase is successful, then Sporting will invest £2.5 million in year one to build a plant that will generate expected annual free cash flows of £350,000 in perpetuity beginning in year two. If the test marketing is not successful, Sporting can still go ahead and build the new plant, but the expected annual free cash flows would be only £150,000 in perpetuity beginning in year two. Sporting’s cost of capital is 10%.

REQUIRED:

i. Calculate the NPV of the road bike project. (5 marks)

ii. Suppose that Sporting has the option to sell the prototype road bike to a competitor in year one for £500,000. This option is available regardless of whether the piloting stage succeeds or not. What is the NPV of the Road Bike Project in this case? What is the value of this option? (6 marks)

(Total 40 marks)

Question 12 企业财务代写

a)

Somid plc is considering a project that will contribute £5 million in free cash flows the first year, growing by 2% per year thereafter. The project will cost £40 million and will be financed with £20.88 million in new debt initially with a constant debt-to-equity ratio maintained thereafter. Somid has an equity cost of capital of 13% and a debt cost of capital of 5%. The firm maintains a debt-to-equity ratio of 50%. Somid’s corporate tax rate is 21%; the tax rate on interest income is 24%; and the tax rate on equity income is 20%.

REQUIRED:

i. Calculate the NPV of the project using the Adjusted Present Value method. (8 marks)

ii. Show that the NPV of the project calculated using the WACC method matches the result you obtained in part (i)? (2 marks)

iii. Suppose that Matrix Systems, a company operating in the same industry as Somid, has no debt initially (i.e., it is an all equity financed company). Matrix has an equity cost of capital of 12% and a current market capitalization of £95 million. The company’s free cash flows are expected to grow at 3% per year forever. Matrix’s corporate tax rate is 36%. The management of the company has decided to add debt for the first time to its capital structure and to maintain a 50% debt-to-value ratio going forward. If Matrix’s debt cost of capital is 6%, what will Matrix’s levered value be? (6 marks)

b) 企业财务代写

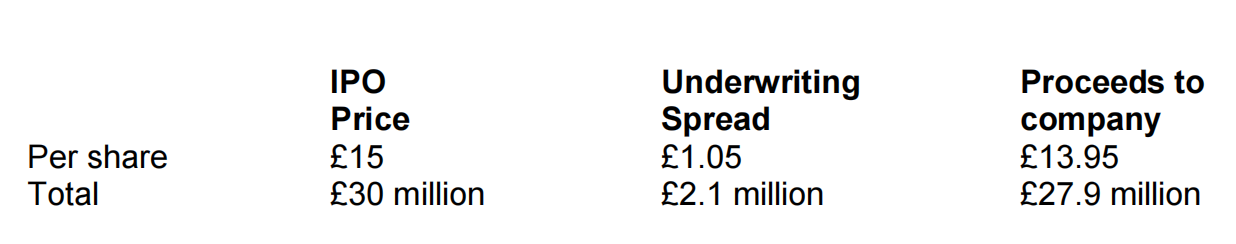

FooTech is a private company that is about to go public through a traditional firm commitment IPO process. The company is offering 2 million shares for sale in the IPO. Below is an extract from the cover page of the IPO prospectus showing relevant information about the IPO.

Footnote: The company has granted the underwriter an option for 30 days to purchase an additional 300,000 shares at the initial public offering price per share, less the underwriting discount, solely to cover over-allotments.

REQUIRED:

i. Explain who is responsible for selling the shares and how many shares will be marketed or offered for sale initially. (4 marks)

ii. Explain how the underwriter will react if the share price falls to £12 in the immediate period following the IPO. (4 marks)

iii. Explain how the underwriter will react if the share price rises to £17 in the immediate period following the IPO. (4 marks)

c) 企业财务代写

Suppose a firm is considering building a new factory today at a cost of £225,000. This factory is expected to produce cash flows of £25,000 per year for 22 years starting a year from today. Within 2 years, if the product is a success, then the plant could be expanded at a cost of £120,000 (i.e., the option to expand can only be exercised within 2 years from today). The expected cash flows from this expansion would be £18,000 per year for 20 years with the first cash flow coming 1 year after the expansion is complete (i.e., 3 years from today). The standard deviation of returns on the expansion is 25%. The risk-free rate is 4%. The cost of capital for the project is 10%.

REQUIRED:

i. Use the Black-Scholes Option Pricing Model to value the expansion option. (8 marks)

ii. Should the company build the factory? (4 marks)

(Total 40 marks)

Section C 企业财务代写

Answer EITHER Question 13 OR Question 14.

Answer all parts of the chosen question.

Question 13

a)

As the financial manager of a furniture retailer you need to consider the purchase of 10 forklifts to be used at the warehouses of the firm. The 10 forklifts would cost £725,000. The forklifts would qualify for accelerated depreciation: 25% can be expensed immediately, followed by 23%, 20%, 17%, 15% over the next 4 years.

You are also entertaining a lease offer for the 10 forklifts. The annual lease payments would amount to £188,500 and the lease term is five years. The lease would qualify as a true tax lease.

Due to the heavy use of the forklifts, you can assume they’ll be worthless after 5 years.

With the recent government reduction in business rates during the Covid pandemic, you estimate the marginal tax rate to be only 9% over the next 4 years. Suppose that the borrowing cost is 1.8%.

REQUIRED:

i. Should you advise to buy or to lease the forklifts? Explain and show all your calculations. (7 marks)

ii. If this were a non-tax lease, would you change your advice provided in part (i)? Why or why not? Explain and show your calculations. (3 marks)

iii. The CEO of the firm is really concerned about short-term financial needs that might arise from a new lockdown and is asking the amount of the savings in year 0 from leasing? (2 marks)

b) 企业财务代写

Kovir LP and Nilfgard Corp. have both expressed some interest into acquiring Temeria Inc. Nilfgard is currently trading at £67.03 per share, while Kovir is currently trading at £45 and has 400 million shares outstanding. Temeria is trading at £18.69 per share with an implied pre merger value of Temeria of approximately £4 billion.

The main rationale for the acquisition provided by Nilfgard is that under their management, Temeria could generate projected synergies of £873,000,000. By February 2021, the board of Temeria is secretively negotiating the terms of the potential acquisition by Nilfgard.

REQUIRED:

i. How far can Temeria push the negotiations for the exchange ratio in case of a stock swap offered by Nilfgard? Explain why. (5 marks)

ii. Suppose Temeria pushes too far with Nilfgard and negotiations don’t go through. The same day Kovir makes a public announcement where they offer an exchange ratio such that, at the current pre-announcement share prices for both firms, the offer represents a 25% premium to buy Temeria. What is the price of Temeria and Kovir immediately after the announcement? (5 marks)

iii. What is the premium Kovir will pay? (2 marks)

c) 企业财务代写

There is a proxy voting for Magia General corp. (a pharmaceutical company specialized in Biotech and AI applications to health solutions). As a shareholder you need to cast your vote for 3 items presented in the proxy statement: election of directors, say on pay and a shareholder proposal.

i. Item 1: Election of directors

Magia General has a strong commitment to guarantee shareholders a Corporate Governance structure that guarantees a strong team of six board members that support, advise and monitor the CEO.

The main criteria for the preselection of candidates is based on expertise, integrity, independence, diversity and experience. The company is also committed to guarantee director’s turnover by asking board members to present their resignation by the age of 72.

Please, find below a slate of candidates that fulfil the firm’s criteria for being a member of the board.

A. 企业财务代写

Gerald Vengerberg. Executive director and Chairman of the board. Age 51. CEO and Co-founder of the company. MBA Lancaster University (1999). Has been working over two decades as the CEO focused mostly into the commercial and production growth. Currently serves as a director at LongTransport CO.

B.

Mrs. Yennefer Vengerberg. Independent director. Age: 38. MBA Stanford. VP Amazing.com (biggest online retailer of handbags in the world) with ample experience in retail and product placement.

C.

Mark Smith. Lead Independent director. Age 74. Founder of the firm. PhD in Chemistry with extensive experience in lab innovation. Had the initial idea of a chemical component that could be adapted and created the main product of the firm in 1993. Company actually started in a home-lab in his garage. Left the management of the firm early in 2001 and has been serving in the board of Magia General for 12 years.

D. 企业财务代写

Linda Solo. Lead independent director. Age 56. Engineer. CEO of EnvironmentUK (an NGO promoting environmental efficiency in the production of chemical products).

E.

Tim Jones. Executive director. Age 45. First partner of the firm. PhD Chemistry. Recruited by Mark Smith to contribute to the development of the product in the early nineties. Currently serves as a COO of Magia General Corp and is being considered to succeed the current CEO.

F.

Vikram Napal. Independent director. Age 75. CEO of LongTransport Co. with over 15 years of experience in Logistics and retail transport. Mr. Napal has served at the board of Magia General for 9 years.

G.

Lorenzo Lima. Independent director. Age 61. VP Young Investments at New Britain Bank. Over 30 years of experience accelerating young firms. Currently also serves at another 6 boards of public companies.

H. 企业财务代写

Vesemir Amado. Independent director. 67 years old. Former CEO ofSuperSupermarkets. Over 40 years of experience in retail, has served as a Director at over 7 boards in his lifetime. Has mentored several successful younger CEOs.

I.

Maria Aalto. Independent director. Age: 31. AI serial entrepreneur with various technological start-ups in Latvia and Finland. Currently sits at 2 boards.

J.

Robert Dash. Independent director. Age: 51. MBA Lancaster University (’99). Founder and CEO of the largest FinTech in the UK.

REQUIRED: Cast a vote for or against each candidate (making sure you vote in favour of at most 6 candidates) and provide reasons for positive and negative votes. (8 marks)

ii. Item 2: CEO compensation 企业财务代写

Mr. Gerald Vengerberg’s compensation package is formed by three components: basic salary (4%), short-term incentives plan (66%) and longterm incentives plan (30%) and amounts for fiscal year 2020 to a total of £11,500,072.00.

Being the CEO and founder of the company, Mr. Vengerberg’s currently owns 17% of the common shares outstanding of Magia General Corp.

The short-term incentives plan consists of stock options while the long-term incentives plan is entirely formed by restricted stock.

While the performance of the firm has been 12% below that of peers, the stock price has consistently increased during the year 2020 because of the boom of BioTech companies during the Covid-Sars pandemic. For this reason, the Board has decided to grant the 2021 stock options corresponding to the short-term incentive plan backdated to 1st of February 2020.

REQUIRED: Cast your vote and explain your decision. Analyse the compensation package and decide its suitability and adequacy. (4 marks)

iii. Item 3: Shareholder proposals

John C. Hartington, President & CEO, Brighton Investments Fund, Inc., 1091 2nd Street, Suite 35, Napa, California 94559, beneficial owner of 1500 shares of Common Stock, submitted the following proposal:

As CEO of one of the largest pension funds in the country, I urgently ask shareholders to vote FOR the proposal of removing the CEO of Magia General CORP form his role as Chairman of the board and appointing an independent director in that role.

REQUIRED: Cast your vote FOR or AGAINST this proposal and substantiate why. (4 marks)

(Total 40 marks)

Question 14 企业财务代写

a)

You run a chain of local pubs in Lancaster. Since it’s been several months without being able to serve drinks or food to patrons, your firm is experiencing extreme short-term financial needs. You need to obtain £1,290,000 within the next 2 weeks to cover rent, utilities and salary of employees that have been retained during the following 5 months you expect to be affected by the lockdown.

After making some phone calls, you’ve been able to get the following offers as sources of funding:

- Government loan of £19,000 at 0% interest rate, to be returned in 12 months.

- Bank North is offering £1,271,000 for five months at a stated annual rate of 2.75%, using inventory (beer and vintage wine) stored in a field warehouse as collateral. The warehouse charges a £6,000 fee, payable at the end of the five months.

- SouthBank can facilitate borrowing up to £823,000 for five months at an APR of 3.2% and a loan origination fee of 0.02%.

- WestBank offers £1,290,000 for five months at an APR of 2.75%. The bank will require to maintain a (no-interest) compensating balance of 12% of the face-value of the loan and will charge a 0.05% loan origination fee.

REQUIRED:

What would be the best financial strategy that would tide you over the following 5 months? Explain your proposal and show all your calculations. (12 marks)

b) 企业财务代写

Freshona is a gourmet fresh produce seller that operates in the Lancashire area. Until 2019 most of its customers were restaurants. The company would deliver their products using a mini-van owned by Freshona. In 2020 during the several lockdowns experienced across the UK due to the Covid-19 pandemic, Freshona had to face a sudden drop in the demand for their products from restaurants and pubs and decided to innovate by opening an online store for retail customers (offering home delivery). The webpage became suddenly a great success with a large number of parcels of gourmet products ordered online. In November 2020, during the second wave of the pandemic in the UK and in the run-up to Christmas, Freshona is facing a demand that represents over 25 times the number of daily deliveries made before the lockdown and extends way beyond Lancashire area.

The single mini-van that the company has been using is certainly not enough to fulfil the new demand. They urgently need to expand their delivery capacity. Freshona is a highly levered firm with a cost of capital very sensitive to its capital structure. The firm is reinvesting most of the cash generated to increase production, meaning the firm has very little cash available.

REQUIRED:

i. Assuming you are the financial manager of this firm, discuss the potential financial arrangements available to Freshona to fund the expansion of the delivery capacity of the firm as soon as possible. Explain in detail the potential advantages and disadvantages of your proposal. (5 marks)

ii. Since Freshona is cash strapped, you’ve decided to revise the accounts payable policy of the firm. Freshona has an average accounts payable balance of £552,136. Its annual cost of goods sold is £9,820,000, and it receives terms of 2/15, net 30 from its suppliers. Freshona has so far decided to forgo this discount. Is this a good management of accounts payable? Explain showing your calculations. (3 marks)

c) 企业财务代写

You are an independent director of REDANIAN CORP, a small and young independent gaming studio established in Eastern Europe. It is considered to be an underdog in the gaming industry. REDANIAN CORP has a relatively small portfolio of only 3 games, all being characterized for being ground-breaking and their great success among gamers around the world. The company has been publicly traded since 2017 at the polish stock market and is supervised by a board of directors formed by 6 members, out of which 5 are independent.

REDANIAN CORP is currently run by its founder CEO who has been praised for being able to lead the small team of engineers, writers and designers that have worked together developing the trilogy of games that have received the award of best game of the year (beating even the games developed by mainstream US and Japanese studios). The company is extremely user oriented, being greatly generous with subscribers. Unlike their mainstream competitors, REDANIAN CORP is constantly making discounts to their customers and giving free subscriptions to expansions. This creates a very loyal customer base.

Since REDANIAN CORP is a small firm, 企业财务代写

The company only focuses on the launch of one game at a time with all the employees devoted to work on the same game. In 2020, REDANIAN CORP was expected to launch a new title that created great expectation among gamers, being the game with the largest number of pre-sales in the history of gaming. REDANIAN CORP creative team considers being innovative and creative a top priority. The employees really value their freedom to create and brake boundaries. The new game is expected to radically change the way role play games are experienced.

Due to the Covid-19 pandemic, the team experienced several delays over 2020 forcing REDANIAN CORP to re-schedule the launch of the new game several times. In February 2021, REDANIAN Corp suffered a security attack to their servers, with copies of the master code of all their products being held hostage by ransomware. Following these two incidents, the stocks of REDANIAN CORP have consistently plummeted.

As of March 2021, the company is facing takeovers threats from the two largest game and console developers in the world: Bony (a Japanese company), and Minecrasoft (a major US based software developer).

The CEO of REDANIAN CORP has called for a board meeting to discuss the takeover threats and the possible strategies to follow.

REQUIRED: 企业财务代写

i. Explain what are the arguments in favour and against antitakeover measures in the specific context of REDANIAN CORP? (4 marks)

ii. Discuss at least two antitakeover measures that might be suitable for a company such as REDANIAN CORP. (2 marks)

iii. In early May 2021 REDANIAN stocks trade at £12 per share. Minecrasoft has approached the management and board of REDANIAN and made a tender offer of £11.89 per share. Is this a hostile take-over? Is this an acceptable offer? Explain. (3 marks)

iv. By mid May 2021 REDANIAN shares trade at £12.34 per share with 1 million shares outstanding. Bony’s CFO assesses that if Bony buys REDANIAN and replaces the management team they can increase REDANIAN’s value by 50%. Bony is considering to make a levered buyout of REDANIAN offering £18 per share. Assuming Bony manages to get control of 50% of REDANIAN, what will be Bony’s gains from this transaction? (7 marks)

v. Assuming that either the merger with Minecrasoft or the acquisition of Bony is completed, which do you think would be the biggest challenges for the acquirer in the years after the transaction to keep REDANIAN running and realising a profit? Explain. (4 marks)

(Total 40 marks)

更多代写:Stata程序代写 线上考试如何作弊 英国Statistics统计学作业代写 英国Essay代写 爱尔兰Media论文代写 大学申请范文代写